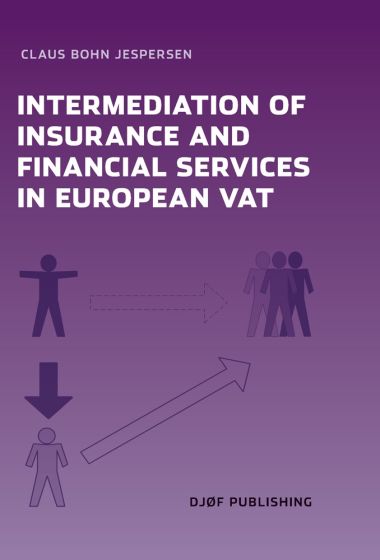

Intermediation of Insurance and Financial Service in European VAT

850,00 kr

500

ISBN

9788757426281

Given the contribution of the value added tax to the Governments of the European Community, the area has had remarkably little attention within legal academic literature. In practice, thousands of lawyers and advisers in Europe deal with these issues on a daily basis and, furthermore, the European VAT system is being 'exported' to other countries around the world, where it is believed that such a taxation system provides an appropriate means of taxation. The question of the treatment of insurance and financial services within the VAT system always gets separate attention.

The book comprises five parts. The first part describes methodology, the second covers analysis of the exemption from VAT in Article 135 (1)(a-f), the third part covers an analysis of the circumstances under which intermediation occurs, the fourth part takes a more practical approach to intermediation services by discussing case law from the ECJ, various Member States and Norway, and the fifth outlines future perspectives on intermediation of insurance and financial services.

The book is based on the ph.d. thesis written by Claus Bohn Jespersen and concerns The Actual and Proposed Legal Treatment of Insurance and Financial Services in European VAT.

Contents

Acknowledgements

Chapter 1-. Introduction

Part I. Methodology

Chapter 2. Methodology of the thesis

Chapter 3. Methods of interpretation applied by the ECJ

Part II. Analysis of intermediation of insurance and financial services

Chapter 4. Intermediation of insurance

Chapter 5. Intermediation of financial services

Chapter 6. Cases from the ECJ on intermediation of insurance and financial services

Chapter 7. One concept of intermediation of insurance and financial services

Part III. Under which circumstances does intermediation within European VAT occur?

Chapter 8. Intermediation services

Chapter 9. Sub- and parallel intermediation

Part IV. Intermediation in a practical perspective

Chapter 10. Intermediation of insurance and financial services in practice

Chapter 11. Administrative, IT and advisory services

Part V. Future perspectives on intermediation of insurance and financial services

Chapter 12. The proposed legal treatment of intermediation services

Appendix

Leterature

List of refernces

List of cases

The book comprises five parts. The first part describes methodology, the second covers analysis of the exemption from VAT in Article 135 (1)(a-f), the third part covers an analysis of the circumstances under which intermediation occurs, the fourth part takes a more practical approach to intermediation services by discussing case law from the ECJ, various Member States and Norway, and the fifth outlines future perspectives on intermediation of insurance and financial services.

The book is based on the ph.d. thesis written by Claus Bohn Jespersen and concerns The Actual and Proposed Legal Treatment of Insurance and Financial Services in European VAT.

Contents

Acknowledgements

Chapter 1-. Introduction

Part I. Methodology

Chapter 2. Methodology of the thesis

Chapter 3. Methods of interpretation applied by the ECJ

Part II. Analysis of intermediation of insurance and financial services

Chapter 4. Intermediation of insurance

Chapter 5. Intermediation of financial services

Chapter 6. Cases from the ECJ on intermediation of insurance and financial services

Chapter 7. One concept of intermediation of insurance and financial services

Part III. Under which circumstances does intermediation within European VAT occur?

Chapter 8. Intermediation services

Chapter 9. Sub- and parallel intermediation

Part IV. Intermediation in a practical perspective

Chapter 10. Intermediation of insurance and financial services in practice

Chapter 11. Administrative, IT and advisory services

Part V. Future perspectives on intermediation of insurance and financial services

Chapter 12. The proposed legal treatment of intermediation services

Appendix

Leterature

List of refernces

List of cases

| Forfatter | Claus Bohn Jespersen |

|---|---|

| Forlag | DJØF Publishing |

| Indbinding | Indbundet |

| Thema koder | Lovgivning om skat og afgifter |

| Varegruppe | Erhverv, div. |

| Ekspedition | DBK |

| Udgivelsesdato | 7. jul. 2011 |

| Sideantal | 446 |

| Bredde | 166 |

| Højde | 237 |

| Dybde | 31 |

| Vægt | 862 |

| Første udgave | 2011 |

| Oplagsdato | 7. jul. 2011 |

| Oplag | 1 |

| Udgave | 1 |

| ISBN-13 | 9788757426281 |

| ISBN-10 | 8757426287 |

| EAN | 9788757426281 |

| Sprog | eng |

| Orignalsprog | eng |

| Illustreret i farver/sh | Nej |